We offer – lending solutions to the other NBFCs who are funding for income generation / business activities, personal loans, education loans and other end use. You can expand your market presence, create a profitable portfolio and venture into newer areas with the aid of our On-lending product.

We offer – lending solutions to the other NBFCs who are funding for income generation / business activities, personal loans, education loans and other end use. You can expand your market presence, create a profitable portfolio and venture into newer areas with the aid of our On-lending product.

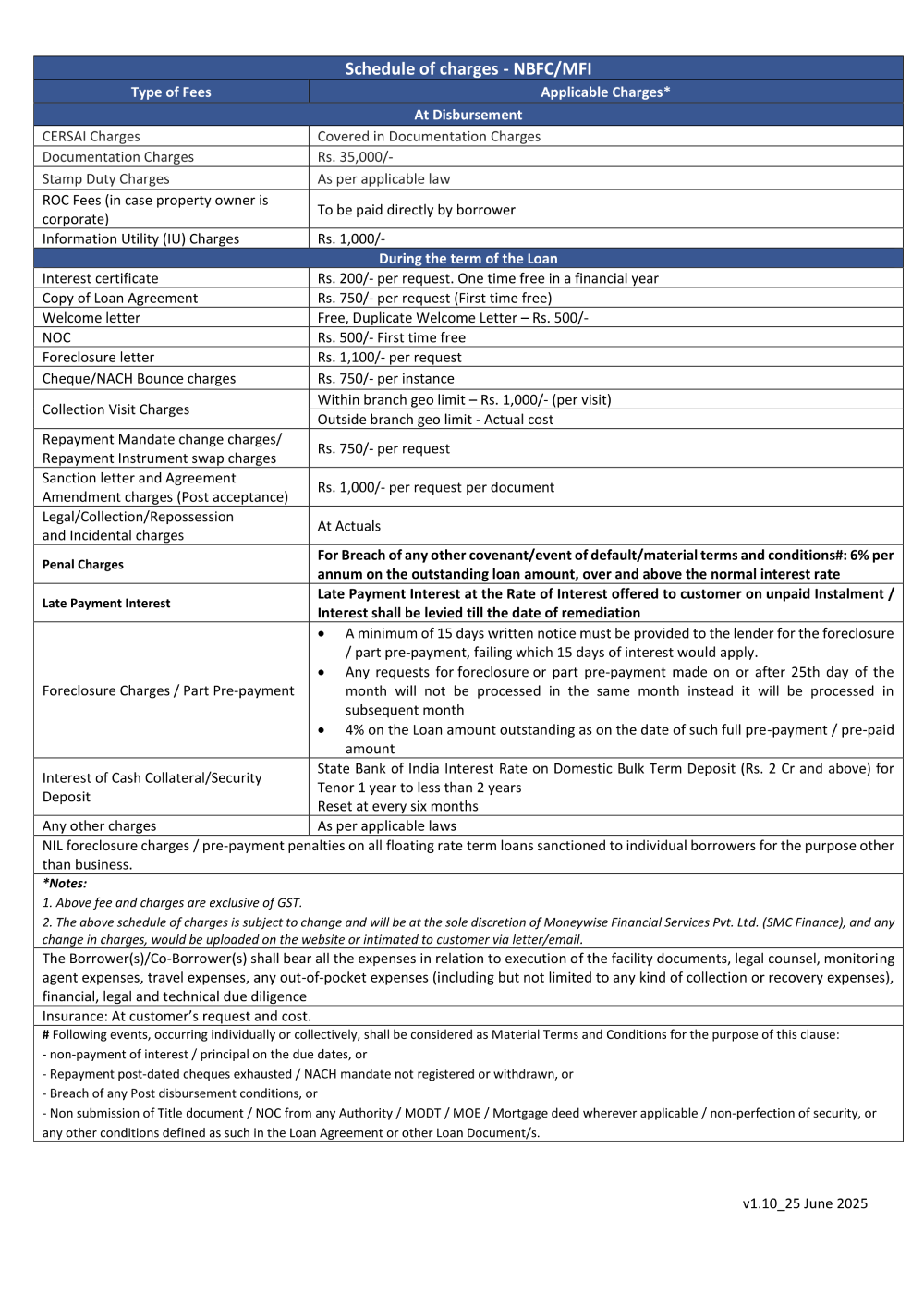

25 June 2025

';