SMC Finance brings the trust and expertise of the SMC Group into the world of financial services. In our product offerings, we are pleased to present Loans against property. With attractive interest rates, transparency in dealings, quick disbursement and minimal paper work, it’s our way of taking you a step closer towards fulfilling your dreams come true.

The multi-purpose loan put funds at your disposal to use as per your need. What’s more, this loan is available at a reasonable rate and can be repaid comfortably over 15 years time.

Loan against property is a loan given by creating mortgage over any of your property.

What are the properties against which Loan can be availed?

You can avail the Loan against the following properties:

What is the maximum amount I can borrow?

In general the maximum amount can be borrowed against residential property is up to 75% and against commercial property is up to 70%. However the loan amount varies case to case basis as it depends upon other factors as well.

When will the loan be disbursed?

Disbursement only be made after credit, technical and legal appraisals of the property have been done, besides execution of loan documents and creation of mortgage over property be made either by deposit of original property documents or by registered mortgage or by both has been completed.

Can I repay the loan ahead of schedule?

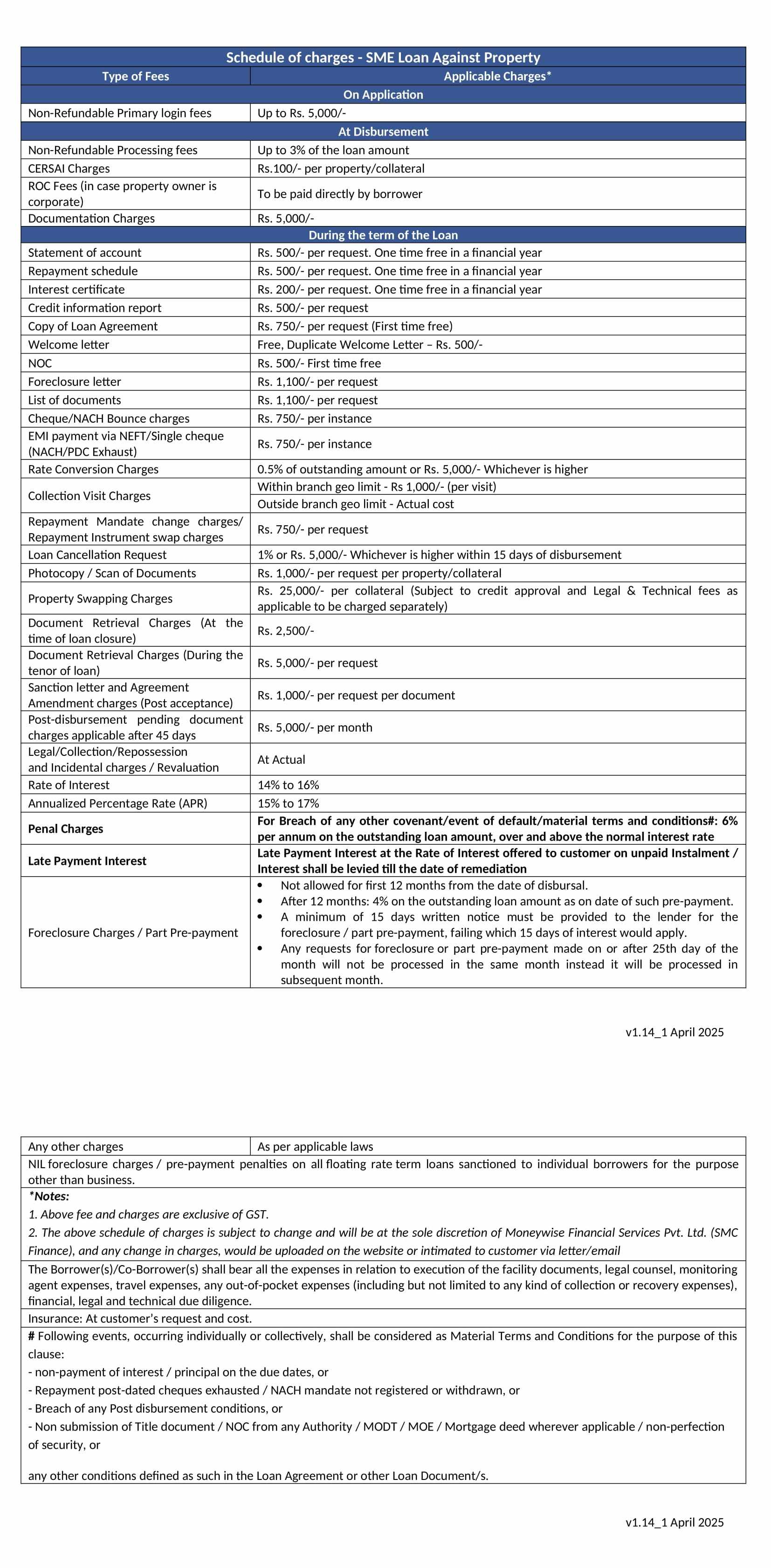

Yes repayment of loan in full or part can be made ahead of schedule. Early redemption or foreclosure charges will be applicable as per schedule in Loan agreement.

SMC Finance brings the trust and expertise of the SMC Group into the world of financial services. In our product offerings, we are pleased to present Loans against property. With attractive interest rates, transparency in dealings, quick disbursement and minimal paper work, it’s our way of taking you a step closer towards fulfilling your dreams come true.

The multi-purpose loan put funds at your disposal to use as per your need. What’s more, this loan is available at a reasonable rate and can be repaid comfortably over 15 years time.

1st April 2025

Loan against property is a loan given by creating mortgage over any of your property.

What are the properties against which Loan can be availed?

You can avail the Loan against the following properties:

What is the maximum amount I can borrow?

In general the maximum amount can be borrowed against residential property is up to 75% and against commercial property is up to 70%. However the loan amount varies case to case basis as it depends upon other factors as well.

When will the loan be disbursed?

Disbursement only be made after credit, technical and legal appraisals of the property have been done, besides execution of loan documents and creation of mortgage over property be made either by deposit of original property documents or by registered mortgage or by both has been completed.

Can I repay the loan ahead of schedule?

Yes repayment of loan in full or part can be made ahead of schedule. Early redemption or foreclosure charges will be applicable as per schedule in Loan agreement.